AGARWOOD

ACQUISITION OF AN AGARWOOD PLANTATIONAgarwood oil is one of the world’s most precious raw materials

Secure your future by owning your own

fully managed agarwood tree plantation in

in amazing Thailand!

WHAT IS AGARWOOD & OUD OIL?

Agarwood is the resinous heartwood that comes from the Aquilaria tree. Aquilaria is a fast-growing subtropical forest tree that our partner grows on numerous sustainably managed plantations in Thailand, Malaysia and Indonesia.

When Agarwood is distilled into an oil, it produces one of the world’s most precious raw materials. Agarwood oil is also known as “OUD OIL”.

Oud Oil is the key ingredient in some of the world’s most expensive fragrances. Renowned brands such as Versace, Calvin Klein and Hugo Boss, to name but a few, all have premium fragrance lines that contain Oud Oil.

As a result of strong demand and limited supply, high quality Oud Oil sold for over USD 50,000 per kilogram.

MARKET DEMAND FOR AGARWOOD

AND OUD OIL

The current global market for “Oud Oil” and other agarwood-related products is worth over US$12 billion per year and growing rapidly. The global fragrance industry is by far the largest buyer of oud oil, and global sales of agarwood and oud oil are expected to exceed US$36 billion by 2030.

THE WORLD LEADER

OUD LUXURY PERFUMES

Oud Oil is a key ingredient in many luxury

luxury brand perfumes. The Oud content of

each perfume generally varies from 0.6 to 8% depending on the

the strength of the Oud essence that the perfumer

wishes to display in the character of the fragrance. In addition to

the perfumes mentioned, Oud is also used in hundreds of

is also used in hundreds of ranges of Middle Eastern and

and bespoke fragrances, as a base note for candles

base notes for candles, incense sticks

soaps and, more recently, face and body creams.

face and body creams. It can also be used

as a raw oil, undiluted and applied to the

body daily.

INDONESIAN OUD

by Ermenegildo Zegna

SUPREME OUD

by Ralph Lauren

VELVET TENDER OUD

by Dolce & Gabanna

OUD EDITION

by Roberto Cavalli

INTRODUCTION TO PLANTATION OWNERSHIP

Today, our partner offers you a simple and easy way to become the owner of a fully managed agarwood tree plantation, just an hour’s drive from Bangkok in Chonburi, Thailand. And now you can be part of the multi-billion dollar fragrance industry without the stress and hassle of doing it yourself. Our partner’s professionals will take care of everything for you, from Soil to Oil to Market. All you have to do is sit back, relax and watch your trees grow.

Plantation ownership is particularly attractive for those wishing to own a tangible, profitable asset class that offers a much safer alternative to traditional equities, bonds and fixed bank deposits. Trees have an extremely low level of financial volatility and offer guaranteed returns. Our partner has all the knowledge, skills and experience to do all this effortlessly for you. In fact, we do it every day!

From Soil – to Oil – to Market

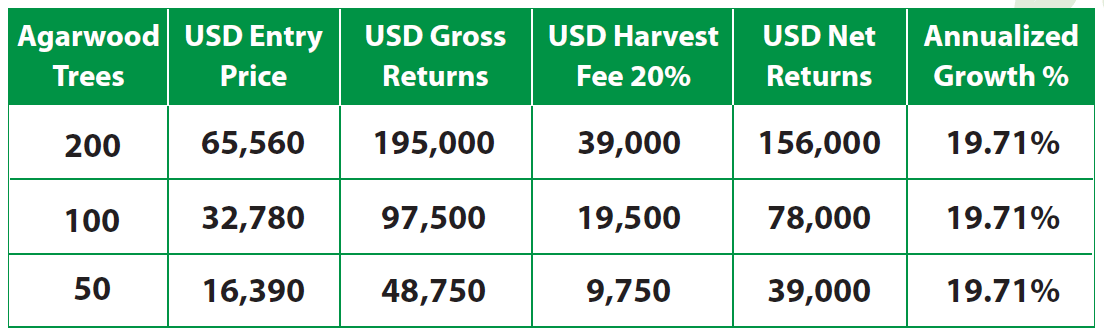

ENTRY PRICE &

HARVEST YIELD

We are pleased to offer you this opportunity to own an Agarwood tree plantation located in Chonburi, Thailand. This opportunity offers you an Expected Average Annual Net Returns of 19.71% or more.

PLANTATIONS OWNERSHIP HIGHLIGHTS

- High Return Portfolio Diversification

- 19.71% Expected Average Annual Net Returns

- Fully managed ‘‘Hands-Free’’ project

- Guaranteed minimum sale price

- 100% replacement guarantee

- Agarwood is a USD 12 Billion plus a year industry

- Existing end user off-take agreements in place

- Proven & experienced management team

- Completely transparent and secure

Agarwood is the most expensive raw material in the world. Quality “Oud Oil” sells for more than

USD 50,000 per kilogram.

FORESTRY AS AN ASSET CLASS

Over the past decade, forestry plantations have moved out of the alternative market space to become the main asset class of choice for sophisticated individuals looking to diversify their portfolios and hedge against traditional markets.

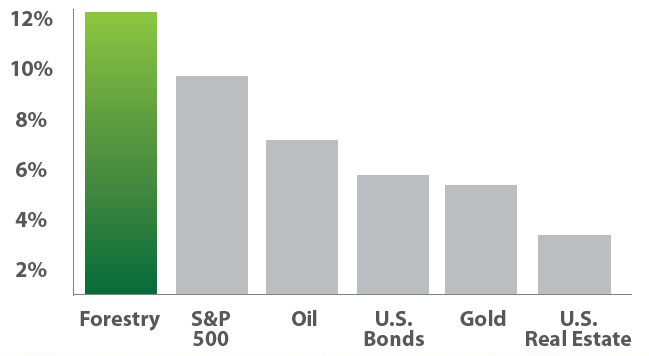

FORESTERY VS. OTHER ASSET CLASSES (1987-2019)

Superior Performance

Forestry in the longterm has outperformed almost all asset classes including equities, bonds, oil, gold and real estate. This is particularly true on a risk adjusted basis due to lower volatility.

Inflation Hedging

Forestry protects against inflation better than many other assets. A trees value grows regardless of market conditions and owners can benefit from rising prices by selling their harvested products.

Diversification

Forestry provides good diversification since it’s not heavily reliant on financial markets. It has historically low correlation with other assets in addition to being a natural inflation hedge.

Biological Growth

Biological growth is unrelated to the performance of the economy. Trees keep growing and increase in value as they age.

WELCOME TO Thailand

Over the Past 100 Years, Forestry as an

Asset Class Has Consistently

Outperformed Most Stocks, Bonds & Fixed

Deposits, and Offers You a Smart Way to

Diversify Your Portfolio

WHY YOU SHOULD INVEST IN FORESTRY IN THAILAND

Travelling to the kingdom of Thailand is no longer limited to shopping, tourism, or relaxation purpose only, the country is now fast growing its economy and inviting people from around the world to make investments in various business areas.

The Thai government has always believed in the free and open economy and is acknowledged for its clarity in dealing with foreign investors.

According to a rescent World Bank report, Thailand ranked 13th from 181 countries in the category of easy business performance. Since then, Thai markets have become friendlier and created more opportunities for foreign investments.

KEY ADVANTAGES FOR INVESTORS IN THAILAND

- Superb Location in the Heart of Asia

- Investment Welcoming Thai Government

- Infrastructure and Natural Resources

- Young and Dynamic Workforce

- Open Foreign Direct Investment Policies

- ASEAN Free Trade Association

- Investor Protection Legislation